When is the best time to visit Queensland?

There is no wrong time to visit Queensland, but knowing more about the weather and the high and low seasons can help you choose the best times.

Queensland Event Calendar

Public holidays in queensland 2024-2025, school holidays in queensland 2024-2025.

This page may contain affiliate links. Read our full disclosure policy for more information.

If you have a particular type of accommodation in mind or want a wide range of choices, I suggest booking in advance. This is particularly true in the Christmas summer holidays and in July and August in places like Cairns, Noosa and the Gold Coast.

Winter sees Australians from the southern states head north in large numbers, so May – September can be busy in most coastal towns.

Got a question? Head over to our Australia Travel Tips Facebook Group and ask a local.

Weather in Queensland

With almost 300 sunny days a year, it’s no surprise that Queensland is nicknamed “the sunshine state” The other phrase that gets thrown around a lot is “Beautiful one day, perfect the next”, unless there is a cyclone or a flood that is! The second-largest state in Australia has three climate zones. From the NSW border to about Mackay is considered to be subtropical. While you will get four seasons, the winters are very mild. Inland of this part of the state, you will find hot, dry summers and warm winters.

From Mackay to Cape York, the area is known as North and Far North Queensland. It becomes more of a two season situation, known as the wet and the dry. The wet season begins in November and ends in May. Things are a lot drier from June to October. Summers here are humid, and winters are warm.

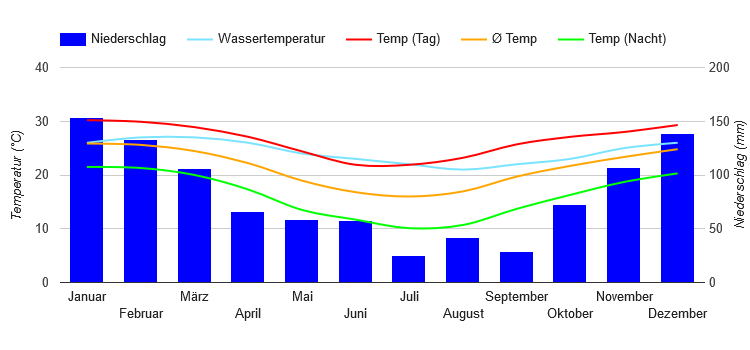

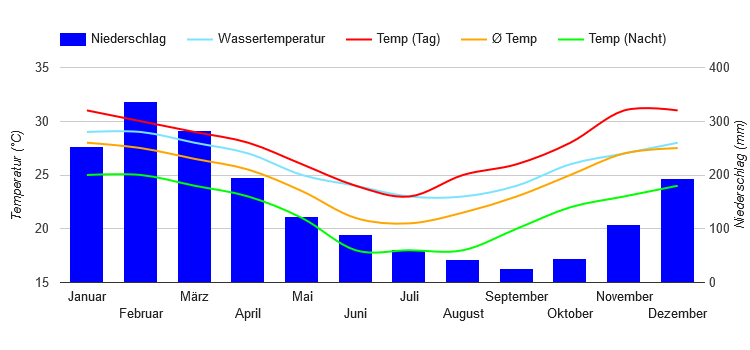

As you will see in the chart below, Cairns gets significantly more rain than Brisbane. Those periods of high rainfall are pretty humid, and I would recommend you make sure your accommodation is air-conditioned.

Below are some of the most significant events on the Queensland calendar. We will update this as new information becomes available, but you should also check the official regional tourism pages when you book.

Queensland School and Public Holidays

School holidays see prices go up and availability reduce. If you don’t need to be travelling at this time, you can save quite a bit by avoiding it.

Privacy Overview

The Best Time to Visit Queensland, Australia for Weather, Safety, & Tourism

The best times to visit Queensland for ideal weather are

June 4th to November 4th

based on average temperature and humidity from NOAA (the National Oceanic and Atmospheric Administration). Read below for more weather and travel details.

Queensland Travel Guide

Temperature.

- Perceived Temperature

- Rain and snow

- Humidity and wind

- The busiest and least popular months

- Overall travel experience by time of year

Other Queensland Travel Info

Weather in queensland.

Average temperatures in Queensland vary very little. Considering humidity, temperatures feel very enjoyable all year with a low chance of precipitation most of the year. The area is more temperate than most — in the 81st percentile for pleasant weather — compared to tourist destinations worldwide. Weeks with ideal weather are listed above . If you’re looking for the very warmest time to visit Queensland, the hottest months are December, January, and then March. See average monthly temperatures below. The warmest time of year is generally early to mid December where highs are regularly around 83.4°F (28.6°C) with temperatures rarely dropping below 64.1°F (17.8°C) at night.

Queensland Temperatures (Fahrenheit)

Queensland temperatures (celsius), “feels-like” temperatures.

The way we experience weather isn’t all about temperature. Higher temperatures affect us much more at higher humidity, and colder temperatures feel piercing with high winds. Our perceived temperatures factor in humidity and wind chill to better represent how hot or cold the day feels to a person.

Queensland Perceived Temperature (F)

Queensland perceived temperature (c), average queensland temperatures by month.

Daily highs (averaged for the month) usually give the best indication of the weather. A significantly lower mean and low generally just means it gets colder at night.

Show Fahrenheit

Show celsius, precipitation (rain or snow).

If dry weather is what you’re after, the months with the lowest chance of significant precipitation in Queensland are August, July, and then September. Note that we define “significant precipitation” as .1 inches or more in this section. The lowest chance of rain or snow occurs around early August. For example, on the week of July 30th there are no days of precipitation on average. By contrast, it’s most likely to rain or snow in late January with an average of 2 days of significant precipitation the week of January 22nd.

Chance of Precipitation

The graph below shows the % chance of rainy and snowy days in Queensland.

Snow on the Ground

The graph below shows the average snow on the ground in Queensland (in).

Average Rain and Snow by Month

Show inches, show centimeters, humidity and wind.

Queensland has some high humidity months, with other comfortably humid months. The least humid month is October (52.9% relative humidity), and the most humid month is February (64.4%).

Wind in Queensland is usually calm . The windiest month is January, followed by February and November. January’s average wind speed of around 7.5 knots (8.6 MPH or 13.9 KPH) is considered “a gentle breeze.” Maximum sustained winds (the highest speed for the day lasting more than a few moments) are at their highest in late January and early February where average top sustained speeds reach 13.2 knots, which is considered a moderate breeze.

Relative Humidity (%)

The graph below shows the average % humidity by month in Queensland.

The graph below shows wind speed (max and average) in knots.

Average Wind Speeds

Show wind speeds.

All wind speeds are in knots. 1 knot = 1.15 MPH or 1.85 KPH.

Show Relative Humidity by Month

Is it safe to travel to queensland.

Our best data indicates this area is generally safe. As of Dec 04, 2023 there are no travel advisories or warnings for Australia; exercise normal security precautions. Check this page for any recent changes or regions to avoid: Travel Advice and Advisories . This advisory was last updated on Nov 30, 2023.

The Busiest and Least Crowded Months

The busiest month for tourism in Queensland, Australia is May, followed by July and August. Prices for hotels and flights will be most expensive during these months, though you can save if you purchase well in advance. Tourists are unlikely to visit Queensland in December. Those willing to visit at these times will likely find it the least expensive month.

Estimated Tourism by Month

Most popular months to visit, overall queensland travel experience by season, fall (march through may).

Humidity and temperatures combine to make this season feel warm. Highs range from 82.8°F (28.2°C) and 75.5°F (24.2°C) with colder temperatures in the later months. Rain is somewhat common with 4 to 6 days of significant precipitation per month. Fall is the second busiest for tourism, which makes it a good time for those looking for things to do.

Winter (June through August)

The middle-year months have comfortably cool weather with high temperatures that are comfortable. These months see the least precipitation with 2 to 3 days of precipitation per month. June – August is the busiest season for tourism in Queensland, so lodging and other accommodations may cost more than usual.

Spring (September through November)

Spring daily highs range from 82.9°F (28.3°C) and 78.9°F (26.1°C), which will feel very nice given the humidity and wind. It rains or snows a normal amount: 2 to 4 days per month. Tourism is fairly slow during these months due to the weather, so hotels may be lower priced.

Summer (December through February)

Weather is perfect this time of year in Queensland to be enjoyable for warm weather travelers. The average high during this season is between 83.4°F (28.6°C) and 80.2°F (26.8°C). On average, it rains or snows a fair amount: 6 to 7 times per month. These times of year are the slowest with tourists.

Best Times to Travel › Australia › Queensland, Australia

Similar Destinations

- Banana, QL, AU

- Biloela, QL, AU

- Moura, QL, AU

- Bundaberg, QL, AU

- Monto, QL, AU

- Gracemere, QL, AU

- Calliope, QL, AU

- Rockhampton, QL, AU

- Clinton, QL, AU

- West Gladstone, QL, AU

Popular Destinations

- Jaipur, India

- Mykonos, Greece

- Hong Kong, Hong Kong

Best Time to Visit Queensland

Climate Overview

Beach Vacation in February

Best Time to Visit Queensland: Overview

Best time to visit the regions, climate charts queensland.

In the following, you will find climate charts for the regions.

Furthermore, there are some charts you can use for quick comparison of climate between the regions.

Whitsunday Islands

Day Temperatures

Night temperatures, average temperatures, water temperatures, precipitation.

Source of Data: German Weather Service (Offenbach) and Wikipedia

Climate Tables Queensland

Temperatures, precipitation, sunshine in brisbane (queensland), temperatures, precipitation in whitsunday islands (queensland), temperatures, precipitation in longreach (queensland), popular activities, more attractions, current weather and forecast.

Australia: Regions

Activities and Attractions

Distances to queensland, where’s queensland, continent: oceania, queensland: experiences of our visitors.

2 days nice warm weather with lots of sunshine, little wind and no rain.

Weather Rating: 5 stars – Excellent

Share your Experience and Win

Enchanting Australia

Destinations in the vicinity ….

- Imprint / Privacy

- Image Sources

Brisbane Travel Guide

Courtesy of Demosthenes Mateo Jr | Getty Images

Best Times To Visit Brisbane

The best time to visit Brisbane is from March to May – autumn in the Southern Hemisphere. Temperatures during this season hover between the high 50s and mid-80s with little rainfall later in the season. But keep in mind that you will need to slather on the sunscreen: Brisbane sees an average of eight hours of sun per day thanks to its subtropical climate. The city's winter (June to August) and spring (September to November) are also popular times to visit thanks to the mild temps and dry days. But these two seasons also see plenty of hotels booked solid, especially in September during the month-long arts celebration known as the Brisbane Festival. If you're planning to visit during the arts festival, arrange your accommodations well in advance. You'll find better airfare and hotel room deals during Brisbane's wet, humid season, which spans from December all the way to early March. Just note that the soggy weather might put a damper on your outdoor activities.

Weather in Brisbane

Data sourced from the National Climatic Data Center

Find Flight and Hotel Deals

Navigate forward to interact with the calendar and select a date. Press the question mark key to get the keyboard shortcuts for changing dates.

Navigate backward to interact with the calendar and select a date. Press the question mark key to get the keyboard shortcuts for changing dates.

Popular Times to Visit Brisbane

Tourism volume is estimated based on in-market destination search query interest from Google and on travel.usnews.com in 2015-2016. Hotel prices are sourced from a sample of U.S. News Best Hotels rates through 2015-2016.

Explore More of Brisbane

Things To Do

Best Hotels

You might also like

San Francisco

# 3 in Best U.S. Cities to Visit

# 3 in Best Places to Visit in Winter

# 11 in Best Places to Visit in Australia and The Pacific in 2023

If you make a purchase from our site, we may earn a commission. This does not affect the quality or independence of our editorial content.

Recommended

The 18 Best Napa Valley Wineries to Visit in 2024

Lyn Mettler|Sharael Kolberg April 23, 2024

The 25 Best Beaches on the East Coast for 2024

Timothy J. Forster|Sharael Kolberg April 19, 2024

The 50 Best Hotels in the USA 2024

Christina Maggitas February 6, 2024

The 32 Most Famous Landmarks in the World

Gwen Pratesi|Timothy J. Forster February 1, 2024

9 Top All-Inclusive Resorts in Florida for 2024

Gwen Pratesi|Amanda Norcross January 5, 2024

24 Top All-Inclusive Resorts in the U.S. for 2024

Erin Evans January 4, 2024

26 Top Adults-Only All-Inclusive Resorts for 2024

Zach Watson December 28, 2023

Solo Vacations: The 36 Best Places to Travel Alone in 2024

Lyn Mettler|Erin Vasta December 22, 2023

26 Cheap Beach Vacations for Travelers on a Budget

Kyle McCarthy|Sharael Kolberg December 4, 2023

The 50 Most Beautiful White Sand Beaches in the World

Holly Johnson December 1, 2023

Best time to visit Queensland

Our verdict

The best time to visit Queensland is March-May

In summer, the daytime temperatures in central Brisbane, Queensland can reach a top of 30℃ (87℉). The temperature at night in the winter can drop to as low as 10℃ (51℉), although this can differ at other destinations across Queensland depending on the geography.

The days are longest in Queensland in November, so if you want to see the sights during the day when the sun is up for the longest time, it’s best to visit around that time of year. To stay dry, avoid travelling to Queensland in March – It’s the wettest month of the year.

Quick links: Fast facts / Seasons / Average temperatures / FAQs / Map

Warmest month

Least rainfall, most daylight, check your travel options, need a place to stay.

*Support us by clicking the links above and making a booking with our partners. It's completely free for you, and it helps us make this site even more awesome! We'll <3 you for it.

ADVERTISEMENT

Queensland seasons

Before you plan your trip, it’s important to know when the seasons are as they may be different to yours depending on where you’re travelling from. Queensland is in the Southern hemisphere, so the seasons fall on:

Best time to visit the top destinations in Queensland

We’ve put together a breakdown of the average minimum and maximum temperatures by month, as well as the best times to visit for each. To learn more about these destinations including detailed climate breakdowns and much more, click or tap the city/destination name below.

Which continent is Queensland in?

What are the best places to visit in queensland, when should i visit queensland for the warmest weather, when does it rain the least in queensland, queensland map.

Explore nearby

Trending destinations

- Guadalajara, Mexico

- Ensenada, Mexico

- Las Palmas, Gran Canaria

- Aberdeen, Scotland

- Sao Paulo, Brazil

- Marseille, France

- Brighton, UK

- Pattaya, Thailand

- Punta Arenas, Chile

- Gold Coast, Australia

Need a hotel in Queensland?

Find hotels and stays for any budget in Queensland with our partners, Booking.com !

When is the best time to go to Australia?

Nov 27, 2023 • 7 min read

Plan the right time for your visit to Australia with this seasonal guide to what's happening through the year © davidf / Getty Images

As the sixth-largest country in the world, Australia has landscapes that range from dry savannahs and scrubland to lush tropical rainforests.

Each season brings its own magic, depending on where you are and when. Summer can either mean comfortable temperate days, blistering desert heat, or days of extreme humidity and frequent rain. Similarly, winter can deliver both snow or sunshine, depending on your location – and preference.

In short, the best time to travel to Australia depends on what you plan to do . From festivals to whale watching and wildflowers, here’s a seasonal breakdown of what's happening through the year.

December to February is the best time for beach days and festival vibes

Thoughts of Australia often conjure summer scenes of clear skies, brilliant sunshine and the sparkling ocean. December to February brings the hottest months with the longest days. This is also the peak travel season, so come prepared for crowds and premium rates on accommodation, particularly during Australian school holidays (which typically run from late December to late January).

Incredible as they are, there are plenty of ways beyond the beaches to enjoy summer in Australia. As Australia’s tropical north bunkers down for the wet season (with some remote regions such as the Kimberley all but closing up business until “the Dry” returns) this is the time to head south for festivals, sports and sunshine.

Big ticket events in January include the Australian Open tennis tournament in Melbourne and Sydney Festival , a visual and performing arts festival. Also not to be missed are quirky regional events such as Parkes Elvis Festival in rural New South Wales , timed to coincide with the King of Rock and Roll’s birthday.

In February, the world’s second-largest Fringe Festival (after Edinburgh) takes over Adelaide , while the streets are lined with glitter and rainbows for Sydney ’s version of Pride: the Gay and Lesbian Mardi Gras . There are also countless outdoor music festivals (both ticketed and free) across the country during this time, particularly over the New Year’s holiday period.

March to May and September to November are the best months for multi-destination adventures across the country

The shoulder seasons of spring (September to November) and autumn (March to May) can mean more rain in many areas, but much milder temperatures. This makes it easier to experience city and outback life in one trip.

During these periods, you'll find relief from otherwise scorching outback temperatures, making it the ideal time to visit destinations in the Red Centre including Uluru-Kata Tjuta National Park . Meanwhile hiking routes , including Central Australia’s Larapinta Trail, South Australia’s Heyson Trail and Cathedral Gorge in Western Australia’s Purnululu National Park, are a lot more manageable in the cooler months.

If you’re visiting the Kimberley between March and May, you may also be rewarded with glimpses of the waterfalls at the tail end of the wet season.

However, it pays to be aware that schools take two-week breaks, usually at the beginning of April and the end of September. Many Australian families take holidays during these periods, which can affect the availability and cost of accommodations.

June to August is the best time to snorkel on the Great Barrier Reef or hit the slopes

The winter months of June through August are generally the cheapest time of year to travel throughout much of Australia, with fewer tourists and better deals on flights and accommodations in most areas.

There are exceptions to the rule, though. The drop in temperatures and drier weather drives tourism to iconic destinations such as Uluru, as well as Cairns , Darwin and the Kimberley. (It can also be cooler than many tourists expect, with temperatures in the Red Centre dropping below 0°C/32°F overnight. Pack accordingly.)

In Queensland , jellyfish – including the infamous Irukandji – are less prevalent during winter, which also means it’s an ideal time to snorkel or dive on the Great Barrier Reef .

If you’re planning to visit these areas, be prepared to jostle for accommodation as domestic travelers from the southern states also head north to escape the cold, with most school districts taking a two-week break at the start of July.

However, it’s just as popular to head into the cold. While neighboring New Zealand is better known as a ski destination , Australia also has fantastic snow experiences to appease powder hounds. New South Wales’ aptly named Snowy Mountains – roughly 490km (304 miles) from Sydney – is home to Perisher (the largest ski resort in the country) and the nearby Thredbo resort. In Victoria, you can hit the slopes 385km (239 miles) from Melbourne in Falls Creek or take to the steeper runs of Mt Hotham.

May to September is the time to experience Australia’s winter festivals

Winter doesn’t mean an end to the celebratory vibes. Instead, May to September is a flurry of activity in capital cities and regional hubs across Australia, with festivals to excite avid foodies, art aficionados, music lovers and more.

The return of shorter days is kicked off by Alice Springs ’ Parrtjima Festival in April. The free 10-night festival celebrates First Nations culture with interactive workshops and performances, and sees the MacDonnell Ranges transformed by an incredible light installation.

Next up is Hobart ’s subversive Dark Mofo festival – timed to coincide with the winter solstice in June. It’s one of the country’s most fêted off-season events, with massive bonfires, live music and performance art taking over the Tasmanian city. Dark Mofo is on pause for 2024, but daring visitors can still partake in the annual Nude Solstice Swim and Winter Feast.

Also in June, Sydney’s Vivid Festival draws visitors by the thousands for its light projections and a program of thought-provoking presentations. Similarly, Melbourne’s Rising Festival and Adelaide’s Illuminate both light up the long winter nights with bold projections and installations across the cities, alongside immersive free and ticketed events. Both are held annually between June and July.

On the other side of the country, foodies tuck into the season’s best at Truffle Kerfuffle in Manjimup, WA, followed by the Cabin Fever food and culture festival in July in Margaret River . Finally, if you’re in the Northern Territory in August, you might want to add Darwin Festival of arts and culture to your itinerary.

May to November is prime time for whale watching

If you love marine wildlife, May through to November marks the best months to glimpse whales as they make their twice-annual migration along the coast. Starting from April, tens of thousands of these majestic mammals begin their journey north from their Southern Ocean feeding grounds. They breed and give birth in warmer waters along Australia’s shores, before returning south with their young.

The coastlines of South Australia, Tasmania and Victoria are some of the best places to see southern right whales, while humpbacks and the occasional orca put on a show along the east and west coasts. Western Australia is the place to spot elusive sperm and blue whales.

Another phenomenon you may be lucky enough to see in Tasmania’s southern latitudes at this time of year is the aurora australis or southern lights. Popular places to witness the dancing colors include Cradle Mountain-Lake St Clair National Park , Bruny Island and the secluded Bathurst Harbour.

August to October is the best time to see rare and endemic wildflowers

We know what you’re thinking. Flowers, for spring? Groundbreaking. But thousands of Australia’s wildflowers bloom nowhere else on the planet. Case in point are the flowers of Western Australia’s southwest. There are more than 12,000 species, 60% of which are endemic to the region. The Indigenous peoples of this region, the Noongar, acknowledge six seasons of the year, and August to October marks the transition to Kambarang , the height of the flowering season. This is celebrated at Perth’s EverNow Festival in October.

Other notable places to experience the wildflower season include the Blue Mountains and Booderee National Park in New South Wales and Ikara-Flinders Ranges National Park in South Australia. Victoria also boasts numerous spots including the Grampians (Gariwerd) , which is home to one-third of the state’s flora and where the flowering season is known locally as petyan . The Dandenong Ranges are also a popular stop, particularly for those wanting to experience wildflowers and a winery or two of the nearby Yarra Valley .

At this time of year, you’ll find countless regional flower festivals across the country, alongside larger celebrations. Two of the biggest are Canberra’s Floriade (the largest flower festival in the southern hemisphere, hosted September to October) and Toowoomba’s Carnival of Flowers in September.

This article was first published Mar 10, 2021 and updated Nov 27, 2023.

Explore related stories

Art and Culture

Apr 4, 2024 • 5 min read

Perth’s immersive Indigenous experiences, stunning scenery and innovative culinary scene make it one of Australia's most exciting cities.

Mar 30, 2024 • 4 min read

Mar 29, 2024 • 19 min read

Mar 26, 2024 • 8 min read

Mar 15, 2024 • 18 min read

Feb 27, 2024 • 6 min read

Feb 15, 2024 • 7 min read

Feb 9, 2024 • 12 min read

Jan 30, 2024 • 9 min read

Jan 24, 2024 • 8 min read

Best Time to Visit Queensland

What is the best time to visit queensland.

The best time to visit Queensland is from December to February. It also depends on your desired activities and preferences. For beach lovers and water enthusiasts, the Australian summer from December to February offers ideal conditions for enjoying the pristine coastlines and engaging in various water sports. The shoulder seasons of autumn (March to May) and spring (September to November) provide pleasant weather for exploring the Great Barrier Reef and national parks, with fewer crowds and comfortable temperatures. Travelers interested in outdoor adventures and rainforest exploration will find the dry season, lasting from April to October, to be the most suitable time, as it offers cooler temperatures and lower humidity for hiking and nature-based activities.

Best time to vist the Top Destinations in Queensland

Best Time to Visit Brisbane

Best Time to Visit Gold Coast

Best Time to Visit Cairns

Best Time to Visit Noosa

Best Time to Visit Fraser Island

Best Time to Visit Townsville

Nearby States

Get the best offers on Travel Packages

Compare package quotes from top travel agents

Compare upto 3 quotes for free

- India (+91)

*Final prices will be shared by our partner agents based on your requirements.

Log in to your account

Welcome to holidify.

Forget Password?

Share this page

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Sweepstakes

- Destinations

The Best Time to Visit Australia for Perfect Weather and Affordable Rates

These are the best times to visit Australia for surfing, hiking, beach hopping, and more.

:max_bytes(150000):strip_icc():format(webp)/Sarah-Reid-0cc15a52771e459e8be5e9eaae794d2c.jpg)

From golden beaches and tropical rain forests to one-of-a-kind wildlife and rich Aboriginal and Torres Strait Islander culture, Australia has a memorable vacation in store for all types of visitors.

Visiting a country so big — complete with three separate time zones and eight different climate zones — requires a degree of planning. To help you get started, keep in mind the following seasons, which apply to most of the continent's tourist hot spots.

- High Season: December to February

- Shoulder Seasons: March to May and September to November

- Low Season: June to August

While city breaks, road trips, and winery visits can be enjoyed year-round, varying regional weather patterns mean that certain highlights — hiking around the iconic monolith of Uluru; snorkeling along the Great Barrier Reef — are best experienced during specific months. No matter what you want to do during your Australia trip, we've got you covered.

Best Times to Visit Australia for Smaller Crowds

Most tourists, especially from the Northern Hemisphere, visit Australia during the country's summer months: December, January, and February. To avoid these crowds, try visiting in winter (Australia's least popular season) or in the spring and fall shoulder seasons.

If you're planning to visit the country's northern coast, opposite rules apply. This region (home to the Great Barrier Reef and the city of Cairns, among other attractions) lies in the tropics. Because of this, the June to August winter months here are warm, dry, and swarming with tourists — both domestic ones on winter vacation and international visitors looking to explore the reef when visibility is at its peak. The summer rainy season, from November to April, is the least crowded time up north.

Best Times to Visit Australia for Good Weather

Every month presents an opportunity to experience a particular region of Australia at its best. If beach hopping is high on your agenda, aim for the warmer months of September to April in New South Wales and southeast Queensland, and November to March in southern states, including the southerly reaches of Western Australia. Summer is also bushfire season, so keep your eye on local alerts during your visit.

While southern states tend to experience four seasons, northern Australia (encompassing the top sections of Western Australia, the Northern Territory, and Queensland) has just two: wet (November to April) and dry (May to October). With road access often compromised during the wet season, the dry period is generally the best time to visit this region, especially on a road trip. The wet period also corresponds with cyclone and marine stinger seasons, which can make coastal travel a challenge. That said, Great Barrier Reef and rain forest tourism in the Cairns region operate year-round, weather permitting. If you want to swim during stinger season — when certain dangerous species of jellyfish populate northeast Australian waters — you'll just need to don a Lycra stinger suit supplied by your marine activity operator.

If you've got your heart set on an Australian outback adventure, the cooler months from May to August are most comfortable. For outdoor adventures in the island state of Tasmania, which has a cooler climate than the mainland, the warmer months from October to March are ideal. If you packed your skis, the snowfields of New South Wales and Victoria are typically open from June until September.

Best Times to Visit Australia for Lower Prices

Flights are usually one of the biggest cost hurdles on a trip to Australia, but there are ways to save. Airfare tends to be lowest during the Aussie winter — June to August — since that's the least popular season for tourism. At any time of year, though, you can find good deals by opting for flights with a layover instead of direct routes (New Zealand, China, and Singapore are some common stopovers) and by watching for sales. Airlines like Virgin Australia and the low-cost Qantas offshoot Jetstar often advertise great domestic deals.

Accommodation prices, meanwhile, can drop significantly in low and shoulder seasons. City breaks in the south's bustling urban centers tend to be most affordable in the winter off-season, too. Though the beaches may be too chilly for a swim, there's still plenty to see at this time of year. Try visiting in May or June to catch the Vivid Sydney festival, when iconic buildings are illuminated by incredible light installations for several weeks.

Best Times to Go Hiking in Australia

Australia's national parks and wilderness areas are laced with hundreds of spectacular hiking trails, many of which are best tackled at certain times of the year. As the summer months can be unbearably hot in Australia's Red Centre, walks in places like Uluru-Kata Tjuta National Park are most comfortably and safely undertaken from April to September.

The opposite can be said for Tasmania, where hiking is more popular during the warmer months, though walkers should be prepared for all types of weather (even snow) throughout the year. Hiking in the lush Gondwana Rainforests of Queensland and New South Wales is typically more comfortable in the drier winter months (particularly June to October), while the best time to wander Western Australia's famed Cape to Cape Track is in the spring (specifically September and October, when wildflowers are in bloom) and autumn (March to May).

Best Times to Go Surfing in Australia

Like in many other destinations around the world, the best months for surfing in Australia don't always coincide with the best months for swimming. If you're just learning how to surf, there's generally no bad time to take a lesson here — though you'll be more comfortable spending hours in the water during the warm summer months of December through February. (This is especially true in Victoria and southern Western Australia.)

For experienced surfers, the offshore winds and more consistent swells of the Australian winter tend to proffer the best conditions, though storms can also generate big waves at any time of year. If you'd rather watch great surfers than join them, try visiting in fall months like March or April — that's when many of the country's biggest surfing competitions, like the Margaret River Pro and Newcastle's Surfest , are held.

Best Times to See Wildlife in Australia

Irjaliina Paavonpera/Travel + Leisure

One of the best things about visiting Australia between May and November is the opportunity to spot migrating whales. Various species make their way up and down the east and west coasts during those months, with different peak times for each species. The best time to book a whale-watching tour in general is August or September, when humpbacks tend to be most active. If you've always wanted to see an orca on the hunt, aim to be in Western Australia's Bremer Bay between January and April.

When it comes to seeing land-based wildlife, it's more about the time of day than the time of year, with the hours of dusk and dawn typically the best for spotting native animals such as kangaroos and wombats. From lorikeets to cockatoos to the iconic kookaburra, Australia's birds (which can often be seen in cities) also tend to sing their hardest when they come in to roost. And after dozing in gum trees all day, koalas are more active in the evenings, making them easier to spot.

Baby animals of all kinds abound in springtime (September to November) across the country. And while sea turtles can be spotted in Australian waters throughout the year, time your visit to Queensland between November and January to see them come ashore to nest, with their babies hatching from January to April.

Worst Times to Visit Australia

Australia's diverse natural beauty and thriving culture mean that there's no bad time to visit. But, depending on your priorities, some times of year can be better than others.

If avoiding crowds and saving money are your top goals, you may want to skip summertime, when tourist numbers and flight and hotel costs reach their annual peak. For beach hopping, avoid the winter — except on the northern coast, where the beaches of Port Douglas and the Whitsunday Islands are at their best in the dry winter months.

International travelers should also note that Easter is surprisingly busy. Australian schools go on break this time of year, and most locals use that time to travel, whether to see family or go on vacation. Since this drives up prices and increases crowds, Easter may be a time to avoid unless you too are there to visit Australian relatives.

Weather & Climate

Best Hotels

Top Things to Do

Best Museums

48-Hour Itinerary

Day Trips From Brisband

Food to Try

Best Restaurants

Nightlife Guide

Best Time to Visit

The Best Time to Visit Brisbane

:max_bytes(150000):strip_icc():format(webp)/IMG_2751-c8e99122470c4e26861511881ad3a6cd.jpg)

TripSavvvy / Maria Ligaya

As the capital of the Sunshine State, Brisbane is the cultural and economic hub of Queensland. To enjoy mild weather and lower crowd levels, the best time to visit Brisbane is from March to May (fall) or September to November (spring).

Unlike tropical Far North Queensland, Brisbane experiences a relatively dry and sunny climate all year round. It is an affordable, diverse, and laid-back city, with plenty to see and do no matter when you visit. Whether you're road-tripping up the East Coast of Australia or flying in for a city escape, read our guide to get the most out of your trip.

The Weather in Brisbane

Brisbane is known as one of the sunniest cities in the world, with around 260 days of sunshine a year and a subtropical climate. In summer (December to February), temperatures reach highs of 84 F degrees, while winter lows dip down just below 50 F degrees. Compared to the rest of Australia, the city experiences less extreme hot and cold conditions.

Rainfall is reasonably low, although there are some thunderstorms in the summer. February is generally the most humid month, with humidity reaching 65 to 70 percent. Spring and fall are warm, often with a breeze, making these seasons an ideal time to visit the city if sightseeing is on the itinerary.

Brisbane is on the river, around a half-hour drive from the coast, but it is surrounded by some of Australia's best beaches. Water temperatures range between 70 and 80 F degrees depending on the season; they reach their warmest in February and coldest in August. Summer is generally considered the best season for surfing in South East Queensland, but you'll be able to find decent waves at different beaches throughout the year.

Popular Events and Festivals

Brisbane's events calendar is largely consistent, with most music festivals taking place during the summer holiday period, sports events during the cooler months, and the huge Brisbane Festival in September. You'll also be able to attend regular events like art exhibitions and farmers' markets during your trip, no matter the season.

Like the rest of Australia, Brisbane observes public holidays at Easter, Christmas, and the New Year, as well as Australia Day (January 26), ANZAC Day (April 25) and the Queen's Birthday (celebrated on the first Monday of October).

Services like banks and the post office, as well as many stores and restaurants, may be closed on these days. Brisbane also has a special public holiday for the Royal Queensland Show on the second Wednesday in August.

Peak Season in Brisbane

Tourists flock to Brisbane during the Australian school vacation periods, especially around Christmastime and as the cooler weather descends on Sydney and Melbourne in June and July.

The Brisbane Festival in September is another big drawcard. Outside these times, the city is hardly ever uncomfortably crowded and you shouldn't have trouble finding accommodation if you book a week or so in advance.

If you're planning to travel further north to Cairns and the Great Barrier Reef, be aware that Far North Queensland experiences a tropical monsoon season. Read our guide to the best time to visit Cairns for more information.

Summer in Brisbane

From December to January, average temperatures range from around 70 to 85 degrees and humidity and rainfall are at their peak. January is a popular time to visit Brisbane, which usually results in higher hotel prices and crowds at pools, beaches, museums, and galleries. Book accommodation in advance if possible and double-check that your room has air conditioning.

Events to check out:

- Woodford Folk Festival is a six-day extravaganza of art, dance, theater, music, comedy, and environmentalism between Christmas and New Year.

- Wildlands is a one-day dance music festival held in late December.

Fall in Brisbane

From March to May, average temperatures drop to the 60s and 70s, with the city experiencing low humidity and fewer rainstorms. This is a pleasant time to visit Brisbane, after the school vacation period has ended and the milder weather has arrived. You will see a slight spike in crowds over Easter, but the extra visitors shouldn't be too much of a hassle.

- Australia's biggest Greek festival, Paniyiri , is a two-day celebration of food, dance, and culture in May.

Winter in Brisbane

Winter in Brisbane (June to August) brings clear days and cool nights, with the water still warm enough to swim in many places and average temperatures ranging between 50 and 70 degrees. This is also the start of humpback whale season off the coast of southern Queensland, which runs until October.

School vacations usually run from mid-June to mid-July, bringing visitors from the southern states and local families out for a day of sightseeing.

- The Brisbane Marathon Festival is a popular running event held in early June.

- The Brisbane International Jazz Festival also takes place at the start of June.

- The State of Origin three-game rugby league series takes place in June and July between the Queensland and NSW teams.

- The Royal Queensland Show (known as the Ekka) brings agriculture, food, carnival rides, and fireworks to Brisbane for a week in August.

- The Bridge to Brisbane is a long-distance fun run held each August.

- The Stradbroke Chamber Music Festival is a series of world-class concerts in incredible natural settings that takes place in late July.

- Brisbane Comedy Festival hosts dozens of local and international acts.

Spring in Brisbane

Temperatures begin to warm up between September and November, and can range from 60 to 77 degrees. Rainfall and humidity also start to rise and accommodation may fill up in September, but the city is otherwise quiet and comfortable. A beach trip or river cruise are good options during this time of year.

- Brisbane's Oktoberfest is Australia's largest German festival, with food, beer, and live entertainment.

- The Good Food & Wine Show brings some of the country's top chefs and producers to the city over a weekend in October.

- Across 11 days in October, the Brisbane International Film Festival presents new features, documentaries, and short films.

- Held in September, the Brisbane Festival is the city's premier international arts and culture event.

- The finalists of the Brisbane Portrait Prize exhibit their work at the Powerhouse at the end of September.

Brisbane enjoys a dry and sunny climate year-round. Still, the best time to visit is from March to May (autumn in the Southern Hemisphere) or September to November (spring in the Southern Hemisphere), when the weather is mild and crowds are low.

Some think Australia's third-largest city pales in comparison to Sydney or Melbourne, however, the small-town vibe, hopping foodie scene, inner-city beaches, and its close proximity to the countryside make Brisbane worth the visit.

June and July are the coldest months in Brisbane, albeit still very mild, with an average high temperature of about 72° Fahrenheit (22° Celsius) and an average low around 68° Fahrenheit (20° Celsius).

Current Results. "Annual Sunshine for Cities in Australia." Retrieved March 10, 2021.

Weather Spark. "Average Weather in Brisbane, Australia Year Round." Retrieved March 10, 2021.

The Best Time to Visit the Great Barrier Reef

The Best Time to Visit Johannesburg

The Best Time to Visit Cape Town

The Best Time to Visit Australia

Cairns & the Great Barrier Reef: Planning Your Trip

Weather in Brisbane: Climate, Seasons, and Average Monthly Temperature

The Best Time to Visit Macao

The Best Time to Visit Morocco

The Best Time to Visit Dubai

The Best Time to Visit Melbourne

Weather in Naples, Italy: Climate, Seasons, and Average Monthly Temperature

Your Trip to Brisbane: The Complete Guide

The Best Time to Visit Boston

The Best Time to Visit the Northern Territory

The Best Time to Visit Spain

The Best Time to Visit Cairns

Australia Recommends 2024

Come and Say G'day

G'day, the short film

Discover your Australia

Travel videos

Deals and offers

Australian Capital Territory

New South Wales

Northern Territory

South Australia

Western Australia

External Territories

The Whitsundays

Mornington Peninsula

Port Douglas

Ningaloo Reef

Airlie Beach

Kangaroo Island

Rottnest Island

Hamilton Island

Lord Howe Island

Tiwi Islands

Phillip Island

Bruny Island

Margaret River

Barossa Valley

The Grampians

Hunter Valley

McLaren Vale

Glass House Mountains

Alice Springs

Uluru and Kata Tjuta

The Kimberley

Flinders Ranges

Kakadu National Park

Eyre Peninsula

Karijini National Park

Great Barrier Reef

Blue Mountains

Daintree Rainforest

Great Ocean Road

Purnululu National Park

Cradle Mountain-Lake St Clair National Park

Litchfield National Park

Aboriginal experiences

Arts and culture

Festivals and events

Food and drink

Adventure and sports

Walks and hikes

Road trips and drives

Beaches and islands

Nature and national parks

Eco-friendly travel

Health and wellness

Family travel

Family destinations

Family road trips

Backpacking

Work and holiday

Beginner's guide

Accessible travel

Planning tips

Trip planner

Australian budget guide

Itinerary planner

Find a travel agent

Find accommodation

Find transport

Visitor information centres

Deals and travel packages

Visa and entry requirements FAQ

Customs and biosecurity

Working Holiday Maker visas

Facts about Australia

Experiences that will make you feel like an Aussie

People and culture

Health and safety FAQ

Cities, states & territories

Iconic places and attractions

When is the best time to visit Australia?

Seasonal travel

Events and festivals

School holidays

Public holidays

How to get to Australia's most iconic cities

How long do I need for my trip to Australia?

How to travel around Australia

Guide to driving in Australia

How to hire a car or campervan

How to plan a family road trip

How to plan an outback road trip

Wildflowers, near Hamelin Pool, Western Australia © Tourism Western Australia

Whether you’re planning your Australian holiday around the weather, or want to travel when things are most affordable, here’s the rundown on the best times to visit Australia.

Australia is home to tropical, subtropical, desert and temperate climates – we’ve got dewy rainforests, sandy plains, snowy alps and sunny beaches. Temperature and climate are important considerations when planning your trip or packing your bags (we’re the land Down Under, so our seasons are the opposite to the Northern Hemisphere). But don’t forget to consider peak seasons, spectacular wildlife events and exciting festivals that could influence your decisions on when to visit Australia.

Get to know Australia’s seasons

Mossman Gorge, Mossman, Queensland © Tourism and Events Queensland

Summer - December through February In summer, the average daily temperatures range from about 20°C to 37°C (68°F to 99°F) in the major capital cities.

Autumn - March through May Things start to cool down slightly in autumn, with temperature averages slipping to between 17°C and 35°C (63°F and 95°F).

Winter - June through August The winter months see average temperatures that range from 11°C (52°F) in the south to 30°C (86°F) in the north.

Spring - September through November Spring boasts average daily temperatures from 17°C and 35°C (63°F and 95°F), from the south to the north, respectively.

Seasons in the tropics

The northern sub-tropical and tropical regions experience two seasons: wet and dry. The wet season, or tropical summer, is between October and April, where you'll experience a mix of sun and rain – making for epic waterfalls – and prices are more affordable. May to September is host to the dry season, with plenty of sunshine and an average maximum temperature around 35°C (95°F).

Read more about Australia's seasons

Australian Travel Seasons

Cradle Mt, Lake St Clair National Park, Tasmania © Laura Helle

Like every country, Australia is bustling at certain times of the year, quiet at others, and builds momentum in between. The peak times generally revolve around weather , school holidays , public holidays and major events . Rest assured, Australia is an amazing place to visit any time of year – whether you’re after frosty fun and a Tasmanian winter or sunny safaris and a tropical Northern Territory summer .

Low season (June-August)

Elysian Retreat, Whitsundays, Queensland © Nathan White Images

Winters in Australia are cool and cloudy, but there’s still plenty of sunshine to enjoy as well. The good thing about travelling during this period is that there are fewer tourists, cheaper flights and you can get great deals on accommodation. This period is peak season in Cairns and Great Barrier Reef region, with an abundance of sunshine and moderate temperatures to enjoy.

Must do winter experiences

When the weather turns cold, there’s no better time to enjoy a wine and admire Australia’s beautiful vineyards. With over 60 designated wine regions across the country, there’s no shortage of gorgeous Australian wine to sip on during the winter months.

Explore things to do in Australia's winter

Shoulder seasons (March-May and September-November)

Jacarandas in bloom, Sydney, New South Wales © DNSW

Spring and autumn are among the best times to travel the entire country. International flights to Australia are more affordable than in summer; the weather is warming up (or cooling down from summer highs); and the north, from Broome to Cairns, experiences the dry season, offering perfect travel conditions.

Must do spring experiences

Spring is wildflower season. Blooms decorate the fields and gardens as flower festivals are held nationwide. It is also a great time to spot wildlife as babies begin to emerge from the pouch and explore the world on their own.

Explore things to do in Australia's spring

Must do autumn experiences

Visitors between April and May can’t miss the rich red outback of the Red Centre . These months mark the start of the dry season when the days are sunny and the nights are warm.

Explore things to do in Australia's autumn

High season (December-February)

Bondi Beach, Sydney, New South Wales © Adam Krowitz

The sun is shining, the temperatures soar and the beaches are dazzling (except in the northern regions, where it's wet season). However, summer is the most expensive time to travel in Australia, with high demand increasing the price of flights and accommodation. The popularity means that it’s important to make bookings well in advance and stay organised, so you won’t miss out. (Hint: Consider February, after kids are back in school.)

Must do summer experiences:

In Australia, you’re never too far away from some of the best beaches in the world. Whether you’re a surfer , snorkeller or a swimmer , you can't miss out on a summer’s day at the beach.

Explore things to do in Australia's summer

More articles like this

We use cookies on this site to enhance your user experience. Find out more . By clicking any link on this page you are giving your consent for us to set cookies.

Acknowledgement of Country

We acknowledge the Traditional Aboriginal and Torres Strait Islander Owners of the land, sea and waters of the Australian continent, and recognise their custodianship of culture and Country for over 60,000 years.

- New Zealand (English)

- United States (English)

- Canada (English)

- United Kingdom (English)

- India (English)

- Malaysia (English)

- Singapore (English)

- Indonesia (Bahasa Indonesia)

- Deutschland (Deutsch)

- France (Français)

- Italia (Italiano)

- 中国大陆 (简体中文)

*Product Disclaimer: Tourism Australia is not the owner, operator, advertiser or promoter of the listed products and services. Information on listed products and services, including Covid-safe accreditations, are provided by the third-party operator on their website or as published on Australian Tourism Data Warehouse where applicable. Rates are indicative based on the minimum and maximum available prices of products and services. Please visit the operator’s website for further information. All prices quoted are in Australian dollars (AUD). Tourism Australia makes no representations whatsoever about any other websites which you may access through its websites such as australia.com. Some websites which are linked to the Tourism Australia website are independent from Tourism Australia and are not under the control of Tourism Australia. Tourism Australia does not endorse or accept any responsibility for the use of websites which are owned or operated by third parties and makes no representation or warranty in relation to the standard, class or fitness for purpose of any services, nor does it endorse or in any respect warrant any products or services by virtue of any information, material or content linked from or to this site.

When is the best time to visit the Gold Coast?

The Gold Coast in Queensland is one of Australia's premier beachside destinations and, in order to maximise your time there, consider planning your trip between April and June. However, that's not to say you can't go at any time of the year.

Thanks to this beautiful spot's sub-tropical climate, reasonably good weather is experienced throughout every season. Whether you fancy sliding down the thrilling AquaLoop at Wet 'n' Wild in summer or marveling at majestic whales as they breach the water in spring, get ready to explore this beloved coastal city.

The weather on the Gold Coast is reasonably good all year round with over 300 days of sunshine on average. However, the climate is classified as sub-tropical, so you can also expect high humidity and frequent storms during the summer.

Despite the often-unpredictable weather and increased chance of rainfall, summer is still a popular time to visit the Gold Coast so be prepared for potentially higher prices and lower availability for accommodation.

The temperatures do get milder in the fall and winter, but they're still high enough to enjoy the beachy lifestyle the Gold Coast is known for. You will have to pack a cardigan or light jacket though as temperatures tend to dip when night falls during the colder seasons.

Best for: visiting beaches, going on rides at the Wet 'n' Wild theme park and hiking up Mount Tambourine

Summers in Australia can get quite warm, especially in the northern regions, and the Gold Coast is no exception. During the months of December, January, and February, the Gold Coast experiences its hottest temperatures with figures reaching up to 86°F+.

If you're not used to the heat, this can be quite uncomfortable and somewhat challenging to manage however there are plenty of places to go and activities to participate in to help you cool down. From taking a dip in the crystal clear waters of Burleigh Heads Beach or in Surfers Paradise to hitting up Wet 'n' Wild for a day of water-based fun, you won't run out of refreshing things to do. Guaranteed.

You'll also be treated to some spectacular storms during summer, as well as the torrential rainfall that inevitably comes with them, so be mindful of the weather conditions before you start planning out your itinerary. Humidity levels will also be quite high so make sure you have water with you when you're out exploring to avoid dehydration.

Best for: fishing, walking/hiking, picnics, and water-based activities such as jet skiing and parasailing

While the season of fall (March-May) is considered to be the Gold Coast's 'peak period', it also happens to be one of the cheaper times to visit with prices lowered when it's not school holidays. This means you can enjoy the season's fantastic weather (think endless blue skies and hours of warm, golden sunshine) without breaking the bank.

Yes, the temperatures average around 73°F (which is slightly lower than the highs experienced in summer) but it's still warm enough to enjoy water-based activities such as swimming, snorkeling, and surfing so get your thongs out and slap on some sunscreen.

Best for: surfing, exploring local art galleries, visiting wineries, and concerts

One of the best things about winter on the Gold Coast, and one of the reasons why this season is one of the best times to visit, is that it's reasonably dry and doesn't experience the volume of rainfall that other Australian regions do during winter.

While temperatures average around 63°F, the days are still clear and sunny, allowing you to explore both the great outdoors and an array of cultural activities.

Winter is also a great time to visit several of Gold Coast's theme parks including Movie World and Sea World (the water-based theme parks all heat the water during the cooler seasons) with fewer crowds and lowered wait times for rides.

Best for: wandering through local markets, swimming, and whale watching

Spring is another great season to visit the Gold Coast with warmer temperatures than those experienced in fall and winter yet cooler than those in summer. The humidity levels are also reasonably low but steadily climbing before hitting peak levels (75% humidity) in summer.

This means you can enjoy the nice, warm weather without having to worry about the tropical storms and frequent rainfall expected as the year progresses. While there's less chance of seeing rainfall during the months of September, October, and November, the wind can be quite strong, potentially affecting activities like dining outdoors and some water-based activities such as parasailing.

If you plan on traveling during spring, be mindful of "schoolies" and other festival periods taking place on the Gold Coast as accommodation prices will rise and there will be larger crowds at popular attractions. Try booking well in advance to avoid unavailability and disappointment.

Let's create an exclusive trip for your group.

10 epic spots to stop at on your east coast Australia road trip

Best nature walks on the Gold Coast

10 things to do in Far North Queensland

All you need to know: Snorkelling in the Great Barrier Reef

8 magical things to do in the Daintree

5 fun things to do in Mission Beach

Ningaloo Reef vs Great Barrier Reef: Where to go on your next coastal adventure

Noosa restaurants: where to eat on your next trip

Awesome, you're subscribed!

Thanks for subscribing! Look out for your first newsletter in your inbox soon!

The best things in life are free.

Sign up for our email to enjoy your city without spending a thing (as well as some options when you’re feeling flush).

Déjà vu! We already have this email. Try another?

By entering your email address you agree to our Terms of Use and Privacy Policy and consent to receive emails from Time Out about news, events, offers and partner promotions.

Love the mag?

Our newsletter hand-delivers the best bits to your inbox. Sign up to unlock our digital magazines and also receive the latest news, events, offers and partner promotions.

- Things to Do

- Food & Drink

- Restaurants & Cafes

- Bars & Pubs

- Attractions

- Los Angeles

Get us in your inbox

🙌 Awesome, you're subscribed!

The 8 best places to visit in Queensland

Get ready to explore the best of the Sunshine State with our curated list of its most captivating spots

So you’re one of the many Southerners who flocked to the Sunshine State. You like our friendly people, warm weather and distinctly unpretentious all-round ambience, but what is there to actually do and see?

Queensland is a warm combination of all our country’s best bits – the coolness and culinary prowess of Melbourne meets quintessential outback Australia, UNESCO World Heritage sites meet annual leave submission-worthy events, and unbelievable road trips meet unbeatable surf culture and hospitality. These are the eight best places to visit in Queensland.

RECOMMENDED: Travel further afar with our ultimate guide of the best things to do in Australia .

An email you’ll actually love

The best places to visit in Queensland

Sunshine Coast Hinterland

In Queensland, most of the time a destination is kind of a three-for-the-price-of-one situation. In the Sunshine Coast Hinterland, you can work your way through a string of charming country towns like Maleny, Montville and Kenilworth, each offering a collection of antique stores, markets, bed and breakfasts, and galleries. The Glass House Mountains, rolling green pastures and rainforests will serve as the backdrop for your winding journey to each town. Australia Zoo is also on the way, as is Nambour and the Big Pineapple. Pull up for the day at one of the many microbreweries or wineries in the area.

Moreton Island

- Redland Islands

With its convenient proximity to Brisbane (just an hour's ferry ride away), Moreton Island is an ideal getaway for unwinding in both luxury and nature over a weekend. Whether you opt to camp behind the sandy dunes, rent one of the island's numerous holiday houses or stay at Tangalooma Island Resort, you'll have plenty of opportunities to indulge in swimming, snorkelling and for 4WD owners, cruising the island's beach highways. The hand-feeding wild dolphin experience is a must, as is donning your finest snorkel and exploring the breathtaking Tangalooma Wrecks. Bonus: there are no requirements to wear a stinger suit in Southeast Queensland because there are no Box jellyfish or Irukandji.

Peregian Beach

- Brisbane City

A friendly, sleepy seaside village waits for you at Peregian Beach, located just over ten kilometres south of Noosa Heads. Its neighbouring beaches are just as lovely, but the quiet ambience and shade of the village square paired with the diverse range of boutique shops, cafés and restaurants is unbeatable. Perigean is the perfect distance from the Noosa National Park, Mount Coolum and stunning neighbouring beaches.

Boodjamulla National Park (Lawn Hill Gorge)

- Parks and gardens

This national park in the remote northwest corner of Outback Queensland is an absolute must-do. The park is currently closed due to damage sustained by flooding but when it’s open you can canoe through sparkling emerald water surrounded by soaring vibrant rock, see native wildlife on walking trails and even spend the night camping under the stars. The World Heritage-listed Riversleigh Fossil Site is close by too.

In North Queensland, Cairns and Port Douglas serve as the quickest entry points to the Great Barrier Reef, the largest and most stunning coral reef ecosystem on Earth. Beaches surrounding Cairns are downright tropical and destinations in their own right. With Cairns as your hub, you can opt for a luxury cruise, sail through the islands, dive to your heart's content or board a scenic flight over the Great Barrier Reef, Heart Reef and Whitehaven Beach. When you’re all dried off, hop back in the car and journey to what Sir David Attenborough called “the most extraordinary place on earth”, the Daintree Rainforest. It's bigger than the entire area of Sydney, millions of years older than the Amazon and you can stay in it in luxe treehouses hidden in the rainforest canopy.

Dramatic arbours of huge Camphor Laurel trees line the streets here, and amidst fresh garden strolls and heritage walks, you can indulge in expertly brewed espresso at stylish cafés, explore an unparalleled urban art scene, sip on afternoon cocktails or catch a show at the theatre. You don’t want to miss the Carnival of Flowers, Festival of Food and Wine, Gather and Graze, or the Curve Ball, so plan trips for September and October.

In the vast and vibrant landscape of Outback Queensland, you'll find a warm and inviting atmosphere, where friendly locals are eager to share stories, crack a cold one and embody the true essence of Outback hospitality. The pinnacle of the Bush, towns in Queensland’s far west are an essential part of Queensland’s tapestry. If you’re road-tripping, be sure to pull off in Longreach and check out the Stockman’s Hall of Fame before arriving in Birdsville, a once-in-a-lifetime experience of a town. Have a beer with locals at the infamous Birdsville Hotel, book a charter flight over the Diamantina channel, Lake Eyre and the Simpson Desert, or (our favourite) board the Big Red Dune Sunset Desert Tour. If you organise your trip for July or September you’ll make it in time for the Birdsville Big Red Run, afterparty Big Red Bash and the Birdsville Races.

One of the easier cities in the Sunshine State to fly into, Brisbane is not only home to an affectionately known ‘brown snake’ of a river running straight through the middle of the city, but some of the best hospitality venues, hotels and experiences in the state. Make a beeline to James Street in Fortitude Valley for café culture Queensland style, upscale shopping and farmers markets in the biggest waterfront, jacaranda-lined park in the city.

[image] [title]

Discover Time Out original video

- Acknowledgement of Country

- Press office

- Investor relations

- Work for Time Out

- Editorial guidelines

- Privacy notice

- Do not sell my information

- Cookie policy

- Accessibility statement

- Terms of use

- Reviews policy

- Competition terms

- About the site

- Modern slavery statement

- Manage cookies

- Advertising

- Time Out Market

When is the Best Time to Visit the Gold Coast?

With about 300 sunny days a year and long stretches of sandy beach, anytime is the best time to visit the Gold Coast. You’ll rarely need to pack a jumper for a stay in this sub-tropical stretch of southern Queensland but hats, sunnies, cossies and thongs are essential year-round.

Temperatures reach a glorious 29℃ in summer and drop to a still pleasant 21℃ in winter. “High season” on the Gold Coast coincides with Christmas school holidays (December and January), when the streets and venues are crowded and the spike in accommodation prices is offset by the attractions: there’s plenty for kids to do and surfing and fishing are at their peak.

Thanks to the Goldie’s crown as Australia’s theme-park capital, school holidays throughout the year are when families head there. The states have different school-holiday schedules so it’s worth timing your visit for when Queensland kids, at least, are back in the classroom.

And just because a season’s “low” doesn’t mean there’s no reason to go. Spring, winter and autumn, outside of school holidays, are considered the shoulder and low seasons but there’s still plenty going on – such as the Groundwater Country Music Festival in November and the Sanctuary Cove International Boat Show in May – with the added bonus of better deals at some of the best accommodation the Gold Coast has to offer.

Autumn’s also prime time as the ocean swells subside after summer and calm seas make for great swimming at one of the GC's stunning beaches, especially when sea temperatures sit at an inviting 25℃.

In winter there’s lower humidity and the steamy days and nights of summer give way to cooler evenings, especially in the hinterland. And winter and spring are for wildlife: June to October is the best time for whale watching . Any of the dozens of lookouts up and down the coast are the place for spotting humpbacks making their annual migration.

Still not sure when to go? Here's our round-up of the best events happening in the Gold Coast...

SEE ALSO: 20 of the Coolest Things to Do in the Gold Coast

Kids will love exploring the towering, colourful artworks created by local and international artists that are scattered along Currumbin Beach for the annual Swell Sculpture Festival – Queensland’s largest – on 10 to 19 September.

A day of sampling cider and craft-beer flights beside the sea is peak Gold Coast in springtime. Chat to brewers, snack on burgers and arancini and enjoy live music in a beachside park in Broadbeach as part of the Crafted Beer & Cider Festival on 11 September.

The second-largest horseracing event in the country after the Melbourne Cup, the Magic Millions Carnival draws punters, thoroughbred dealers and fashionistas to the Gold Coast Turf Club for socialising and all things equine at the height of the Goldie summer in January.

Groundwater Country Music Festival is a three-day celebration of Akubras, banjos and bootscooting that takes over the streets of Broadbeach on 12 to 14 November. This year’s line-up includes Adam Harvey and Gina Jeffreys.

The inaugural 2021 Rosé Coast festival saw fans of the pink stuff gather in Broadbeach to sip varieties from all over the world, matched with eats and tunes. In May next year it returns with a “Sparkling” theme, focusing on bubbles from 20 Australian regions.

Blues on Broadbeach is a free three-day festival, 19 to 22 May, that takes place all over Broadbeach, with the main stage at Kurrawa Park. Previous headliners have included Wolfmother, Christine Anu and Memphis jazz legend Robert Cray.

The Gold Coast’s premier arts and culture event, the Bleach Festival ,, in August, aims to push boundaries and challenge perceptions right across the region from Burleigh Heads to Surfers Paradise. Events include dance, performance and community feasts.

Snow isn’t exactly something you see a lot of in Queensland but in June and July, Winterfest at Dreamworld sees the park transformed into a family-focused wonderland with skating rinks, tobogganing and cosy hot chocs and warming snacks.

SEE ALSO: 14 Fun Things to Do with Kids in the Gold Coast

You may also like.

Travel inspiration and destination guides, plus tips and hacks, straight to your inbox

Discover where you want to go next: trending destinations, new openings and our favourite places

Best time to visit Queensland

Last updated on May 17, 2023

What are the hottest months to visit Queensland in?

What are the coolest months to visit queensland in, what months have the most rainfall to visit queensland in, what months have the least rainfall to visit queensland in, what are the most humid months to visit queensland in, what are the least humid months to visit queensland in, what months have the most wind in queensland, what months have the least wind in queensland, which months have the most cloud cover in queensland, which months have the least cloud cover in queensland, temperature by months in queensland, rain precipitation by months in queensland, humidity by months in queensland, wind speed by months in queensland, cloud coverage by months in queensland, you picked the perfect time to visit queensland, check the staying options there.

- Destinations

- Switzerland

- 9 Luxury Hotels with Water Slides & Aqua Parks

- How Much Does it Cost To Fly First Class Around the World?

- Best Luxury Travel Luggage | Top Designer Bags for Travelers

- Hotel Reviews

- The Dorchester

- Soho Grand Hotel

- Hotel Castille

When Is The Best Time To Visit Australia

Michela Australia Travel Planning 14

A detailed guide on the best time to travel to Australia

When is the best time to travel to Australia ? I often get this question from first-time travellers, and it’s impossible to answer it in one sentence because of many factors. Australia is a vast continent located in the southern hemisphere, which means summer starts in December, as opposed to winter in the northern part of the globe. Many factors factor into the best time to go to Australia.

Before answering this question, I need to spend a few words about its geography and Australia’s weather. With double the size of Europe, the Australian continent stretches from North to South and East to West, covering over six thousand kilometres and crossing different climate zones. As climate and weather conditions change, Australia has all types of weather and climates, so there are multiple answers to this question. On this page, you can read about the various kinds of Australian weather by month, climate zones, and seasons to give you an idea of the best time when planning a trip to Australia .

Australia Weather Map

With summer starting in December and ending in March and winter starting in June and ending in September, Australia has three central climate and weather zones:

- Southern coastal regions from West to East Cities like Perth, Sydney, Melbourne, and Adelaide are in the West’s southern coastal regions to Australia’s East Coast. Here winter is between June and August, and summer months are between December and February. While the west coast has excellent and stable weather all year round, the east coast is more changeable.

- Inner central areas of the Outback When we refer to the Outback regions, we generally think of the Red Centre, but the Outback areas are much larger. They cover most of the entire inland territory of Australia. So winter from June to August has the coldest nights with warm days.

- Tropical Queensland, Northern Territory and North Western Australia . Northern Australia and North West Australia are also Outback areas with cold winter nights and warm days and wet with high humidity on hot summer days. You must be sure to travel off-season in spring between September and November or in autumn between March and May. Winter the best time of year to travel to tropical Australia.

Below is a recap of the Australian weather zones and seasons to help you identify the ideal time to travel to Australia.

Australia in December through February (Summer)

In December, January and February, the Australian weather has the hottest temps, which is the time with the warmest months throughout the country. Temperatures can reach 35-45°C all over the southern coastal areas. In the Outback areas (central Australia), temperatures can reach over 45°C with high air humidity.

Travel season is the peak season, with six weeks of school holidays. It is the busiest time and most expensive to travel around Australia for locals and international travellers alike. So if you do not like crowds or want to save money, avoid going to Australia in Summer from December to February.

However, travelling to Australia in summer have benefits too. Here are some:

- Summer is the best time for visiting Tasmania as temps are around 25-28°C and pleasant for hiking and enjoying the outdoors.

- Most outdoor events occur in summer in South West Australia, South Australia, and the South East Coast of Australia .

- Spending Christmas in Australia is also extraordinary as it is different to celebrate the festive holidays on the beach.

- If you are a beach lover and love all water sports, the Australian summer is the best time for planning a trip along the entire East Coast of Australia, including the Gold Coast . However, the Gold coast lies in a subtropical destination with great temperatures.

Australian Weather in March through May (Autumn)

The weather in Australia in March, April and May is pleasant, mostly all over the country. Temperatures can vary a lot, though. On average, they are around 20-25°C; they gradually decrease towards the winter months. This is my favourite time of the year to visit Australia. Here are some excellent reasons why you should the weather in autumn is great to travel around:

- It is the best time to visit many Australian Outback Regions , including Uluru, as the weather is mild, with warm days and cold nights.

- It is the ideal time to visit South Western Australia and South Australia on sunny days. It’s also a great time of the year for tasting local produce and wine and seeing many events.

- Another part of Australia worth visiting between March and May is the Top End and the Kimberley in North Western Australia .

April usually marks the end of the rainy season, so this month is great if you still want to see some lush green vegetation and gorges filled with water and enjoy active birdlife and wildlife in the beautiful Australian national parks .

Australian weather in June, July and August (Winter)

The Australian winter starts in June and goes through July and August. The winter months have the coldest weather in Australia as far as the southern regions are concerned. Winter in Victoria and Tasmania can have icy weather, sometimes with temperatures around zero degrees. For this reason, it is not ideal to visit this part of Australia in winter.

The winter months in Australia are suitable for visiting the following areas:

- The Australia Top End , with Darwin and the Kakadu National Park . Most Top End events are held between July and August. The weather in the Top End is dry, with very low humidity and cool nights.

- North Tropical Queensland , with lots of sunshine and the best dry weather you can have.

- Central Australia and North-Western Australia for the Outback regions. Here temperatures are around 20-25°C, ideal for Australia’s best road trips and camping.

Winter in Northern Australia is a busy time of the year; everyone wants to escape the cold weather of the south and spend a few days at the sunny beaches of North Australia. That’s why I would plan a trip to Northern Australia to secure cheap flights and the best accommodation and tours.

Australia in September through November (Spring)

From September to November, the Australian weather is good almost everywhere. In Northern Tropical Australia, spring, it’s a transitional period from the dry winter months into the rainy months, December to February. With pleasant temperatures around 20-30°C from the West Coast to the South East Coast , this is the best time to go to Australia, especially South Australia, South East Australia, Queensland and Western Australia.

- South Western Australia is best to enjoy between September and November, with wildflowers blossoming. Moreover, you can enjoy whale watching, hiking, biking, and outdoor activities.